University financial expectations not realistic for college-bound students

Despite the increasingly large divide between rich and poor, high school seniors are noticing that the definition of wealth differs largely between university and reality.

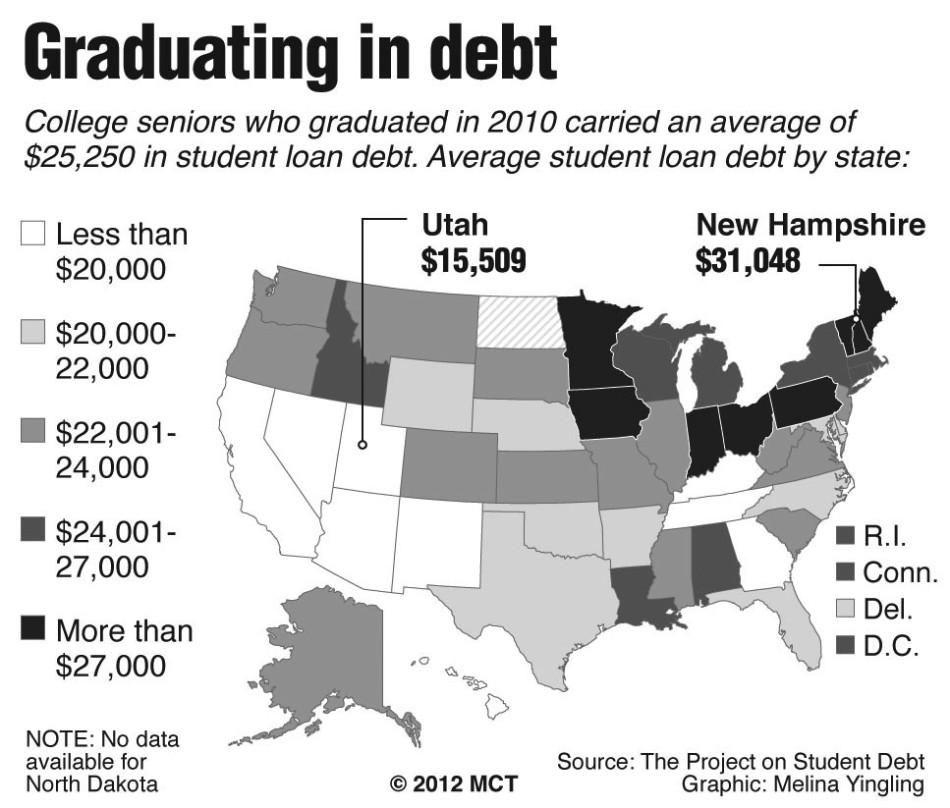

Tuition for college is more expensive than ever and students are feeling the effect of these escalating costs. According to American Student Assistance, “the average student loan balance for all age groups is $24,301,” in 2012.

Now, seniors are finding that if they don’t fall directly under the poverty line, they do not receive relevant financial aid. We are expected to pay the $15,000-40,000 required from most colleges.

And the scary part of it is, colleges pretend the financial interests of every single student are their main priorities. On a financial “reward”, they list out loans that I will pay back upon graduation. My future indebtedness does not feel like a reward to me. Loans that my parents and I have to take out and eventually pay back later at an even higher rate does not equal a zero cost of attendance.

I know students whose dream universities have progressed from Texas A&M, University of California: Los Angeles, George Washington University, and Brown University to any given state school. I know students who can not afford to make the drive down to Tucson but must live at home to even think about affording tuition. And even worse, I know students who are going to skip college because they don’t see the point in spending four years accumulating debt with no guarantee of profit at the end.

It’s not just our students it’s hurting. Parents are finding ways to help their children finance college by all means possible. It’s not even a realistic possibility for anyone not a part of the one percent.

We live in a society where a college degree is practically a requirement for a financially secure life and a successful job. We can not possibly hope for every student to achieve the “American dream” if colleges do not realistically help along the way.

Lindsey Floyd is a senior at Perry High School. She is The Precedent opinions editor, in advanced theatre, head of two clubs, and in five more extracurriculars...