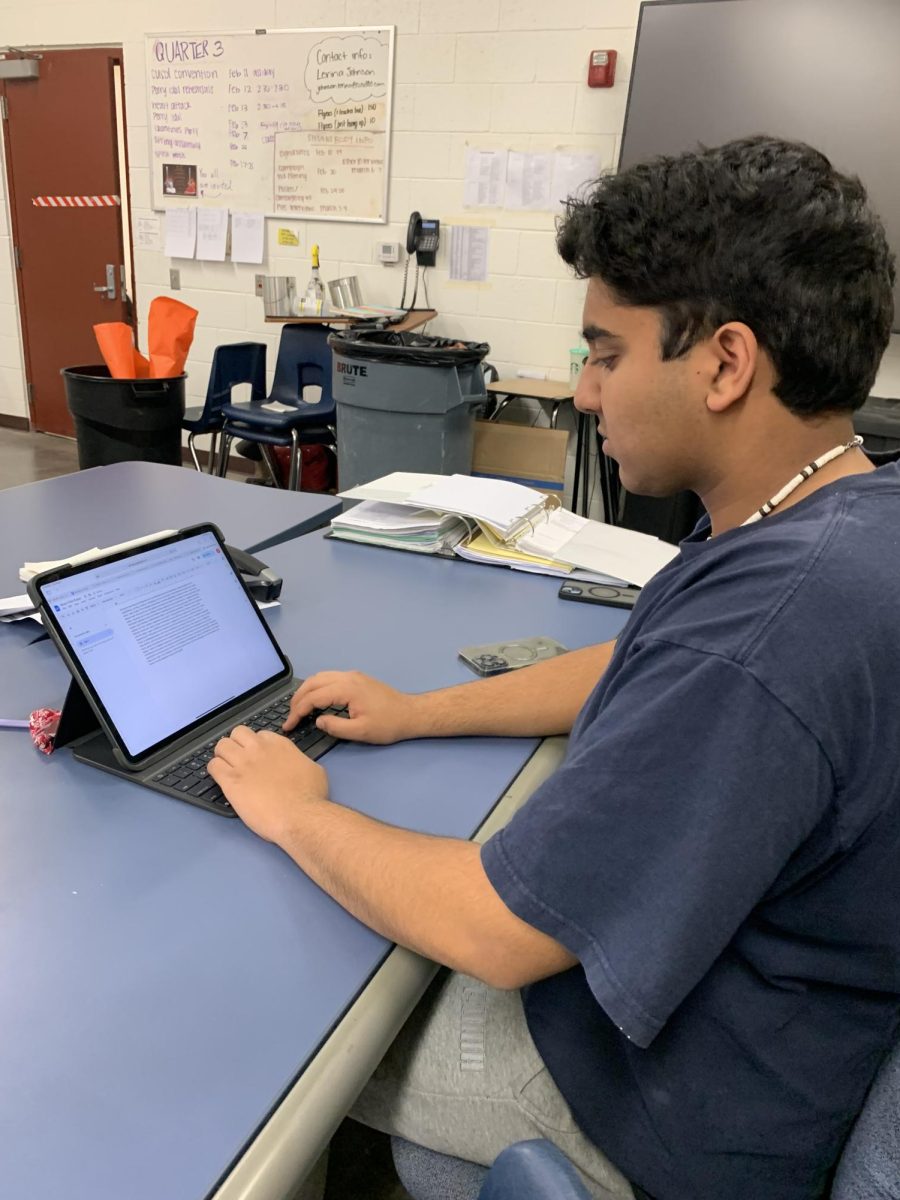

Advanced Placement (AP) students have more than just finals to worry about as summer approaches. AP testing – which occurs throughout May – assesses students on curriculum from their college level courses.

Students can earn college credit from this at a lower price than Dual Enrollment, but this comes with a risk.

In prior years, tax credit could be used to pay for the 89 dollar tests.

The state auditor decided that this was no longer applicable in the district.

“It definitely disadvantages students,” AP Government and Human Geography teacher Jessica Pullen said. “If they are confident in their abilities, the spending of roughly 90 dollar to earn a potential of 6 or up to 12 college credits definitely outweighs it.”

In order to earn the coveted college credit, a student must receive a certain score on the test.

On a one to five scale, a five, four, and sometimes a three are accepted at schools for credit.

For each 89 dollar test, a portion of the money is given to the school and put into an AP testing fund.

This money can be used to help those who have a hard time paying for all their tests.

“If you take three or four [AP tests], it can get pretty expensive,” Principal Dan Serrano said. “We are looking for ways to help the students afford the tests.”

Although the tax credit change may impair some families, it should not have too significant of an effect.

“We have always provided financial aid for those students that qualify,” Assistant Principal Joe Greene said. “Both the state and College Board provide reduced fees and free tests for those who qualify financially.”

This change is not suspected to considerably impact anyone, but if it does there are plenty of ways the school can support them.